|

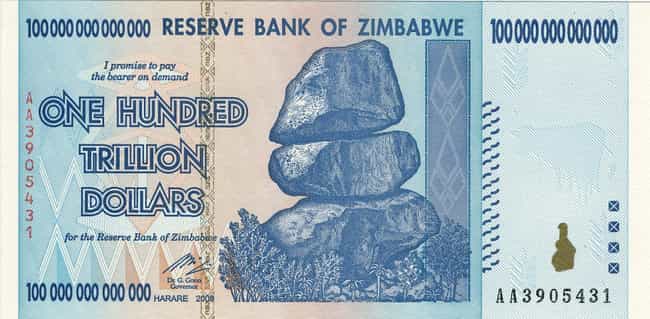

Zimbabwe was in significant trouble in the early aughts, as you can see by the $100 trillion bills pictured above. President Robert Mugabe's land reforms had murdered the country's economy by destroying its main export, commercial farming crops. This left Zimbabwe with essentially no foreign exchange to speak of and skyrocketing prices on basically everything. The government tried to keep itself afloat by printing more and more paper money, which led to hyperinflation, further complicating the problem.

By 2008, Zimbabwe was almost out of paper to print its wildly inflating money on because the German company that supplied materials to Zimbabwe's printer saw the writing on the wall and halted delivery. At thiat point, basic necessities such as food, clothing, and beer had ridiculous price tags. You could buy the newspaper for a cool $25 billion. Not the newspaper company, the newspaper. One newspaper.

In 2009, the government was forced to admit its currency problem. It rolled out a multicurrency system that included the US dollar and the South African rand, plus its own bills, with the 12 pesky zeros conveniently removed. The Zimbabwe dollar didn't work out, and the country officially took it out of circulation in 2015.

When the Zimbabwean dollar first came into existence in 1980 it had a similar value to the US dollar, writes Patrick Collinson. But by 2009, $1 was worth Z$2,621,984,228, 675,650,147,435,579,309,984,228. The Bank of England worries if inflation in the UK goes over 2% a year; in Zimbabwe it hit 79.6 billion per cent.

The country’s central bank could not even afford the paper on which to print its worthless trillion-dollar notes. President Mugabe issued edicts to ban price rises, of comedic value were it not for the devastation that hyperinflation wrought upon the people. The miserably low savings and incomes of the impoverished population were wiped out; shopkeepers would frequently double prices between the morning and afternoon, leaving workers’ pay almost valueless by the end of the day.

In 2009 the government scrapped the currency, leaving US dollars and South African rand as the main notes and coins in circulation. To this day, Zimbabwe still has no currency of its own, although the government last year offered to swap old deposit accounts into US dollars, giving savers $5 for each 175 quadrillion (175,000,000,000,000,000) Zimbabwean dollars.

In an extraordinary irony, Zimbabwe now suffers among the world’s worst deflation, currently at -2.3%.

When the Zimbabwean dollar first came into existence in 1980 it had a similar value to the US dollar, writes Patrick Collinson. But by 2009, $1 was worth Z$2,621,984,228, 675,650,147,435,579,309,984,228. The Bank of England worries if inflation in the UK goes over 2% a year; in Zimbabwe it hit 79.6 billion per cent.

The country’s central bank could not even afford the paper on which to print its worthless trillion-dollar notes. President Mugabe issued edicts to ban price rises, of comedic value were it not for the devastation that hyperinflation wrought upon the people. The miserably low savings and incomes of the impoverished population were wiped out; shopkeepers would frequently double prices between the morning and afternoon, leaving workers’ pay almost valueless by the end of the day.

In 2009 the government scrapped the currency, leaving US dollars and South African rand as the main notes and coins in circulation. To this day, Zimbabwe still has no currency of its own, although the government last year offered to swap old deposit accounts into US dollars, giving savers $5 for each 175 quadrillion (175,000,000,000,000,000) Zimbabwean dollars.

In an extraordinary irony, Zimbabwe now suffers among the world’s worst deflation, currently at -2.3%.

No comments:

Post a Comment